can you pay california state taxes in installments

Furthermore taxes are paid partially in arrears and partially in advance on regulated due dates set by the California State Board of Equalization. California law states that the tax year runs from July 1 through June 30.

Secured Property Taxes Treasurer Tax Collector

California May Still Consider You a Resident for State Income Taxes.

. Make sure to keep enough funds in the bank. Apply by phone mail or in-person. If you are financially unable to pay the tax liability.

There is a separate payment form for each due date. Typically you will have up to 12 months to pay off your balance. We encourage you to borrow from private sources to immediately pay your tax liability in full.

Importantly as soon as you know you cant pay back your taxes contact a tax professional. As an individual youll need to pay a 34 setup fee that is added to your balance when setting up a payment plan. 10 and the second by April 10.

One question that will often arise is whether or not a certain payment or fee is included in a transaction. You may have to pay tax instalments for next years. Recognized gain in year of sale is 40 percent times 500000 or 200000.

Thats gain not tax. Send us each payment with Payment Voucher for Real Estate Withholding Form 593-V 15. By the 20th day of the next month.

Important State gas price and other relief proposals. Local governments collected about 43 billion in 201011 from the 1 percent rate. For instance if you move out of state but work remotely for a California business you may need to pay taxes on those earnings.

Taxes are due N ovember 1st D ecember 10th F ebruary 1st and A pril 10th. The gain is taxed at 15 percent 18 percent or 20 percent for federal depending on your other income based on the 2013 tax act. No unlike your ordinary annual taxes the supplemental tax is a one time tax which dates from the date you take ownership of your property or complete the construction until the end of the tax year on June 30.

Businesses meanwhile are typically required to pay off whats. California state tax rates are 1 2 4 6 8 93 103 113 and 123. The Title Consumer is published by the California Land Title.

The gain is taxed as ordinary income for California. The required annual payment is 90 of the tax shown on the return for the taxable year or 100 of tax shown on the return for the preceding taxable year and. Im happy to report if youre paying by credit card its the cheapest way to pay by credit card in the state of California Treasurer-Tax Collector Amy Christensen said the process is.

Plus accrued penalties and interest until the balance is. This is right about where most taxpayers find themselves. Simply type in the propertys zip.

Make your check or money order payable to the Franchise Tax Board. It may take up to 60 days to process your request. The California Property Tax Calculator provides a free online calculation of ones property tax.

Pay by automatic withdrawal from a bank account. Write your SSN or ITIN and 2021 Form 540-ES on it. Make monthly payments until the taxpayer pays the entire tax bill in full.

The first by Dec. If you are unable to pay your state taxes you can apply for an installment agreement. The Property Tax Is One of the Largest Taxes Californians Pay.

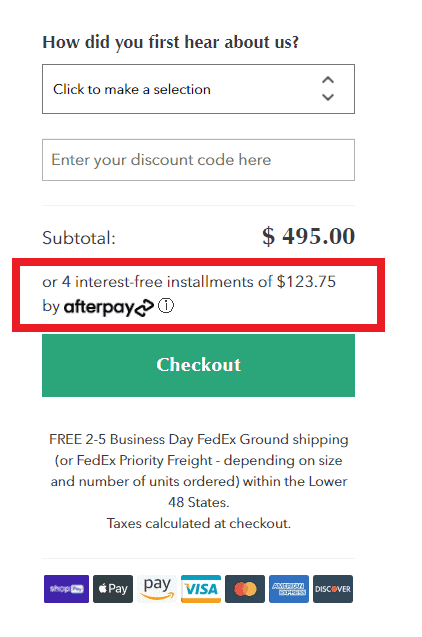

Send the seller a copy of your Form 593. Keep a copy of Form 593 in your records. Franchise Tax Board State of California Installment Agreement Request We will always ask you to immediately pay your tax liability including interest and penalties in full.

The obligation for this tax is entirely that of the property. However this includes rental income and even work income from California businesses. Tax instalments are payments you make throughout the year to cover the taxes you normally pay in one lump sum on April 30 of the following year.

The average effective after exemptions property tax rate in California is 079 compared with a national average of 119. Usually you can have from three to five years to pay off your taxes with a state installment agreement. Use Estimated Tax for Individuals Form 540-ES 5.

The tax rate is 1 of the total home value and the rate can only increase a max of 2 per year. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. A 1 mental health services tax applies to income.

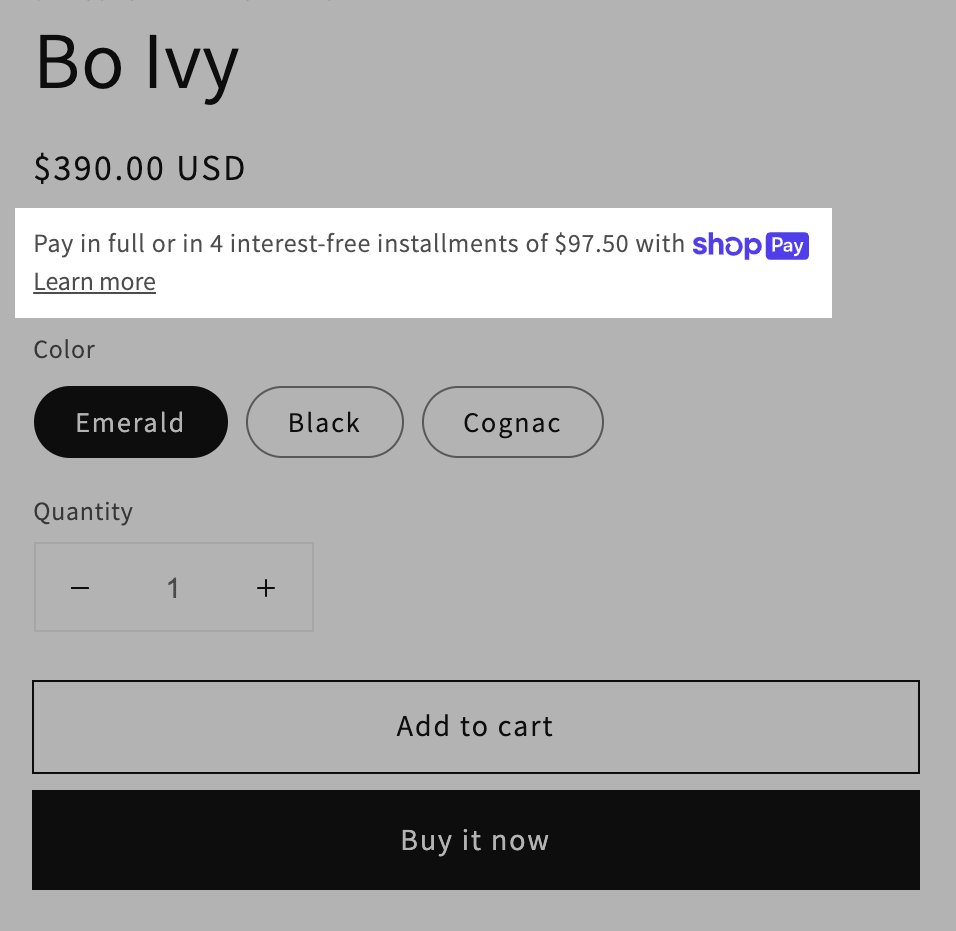

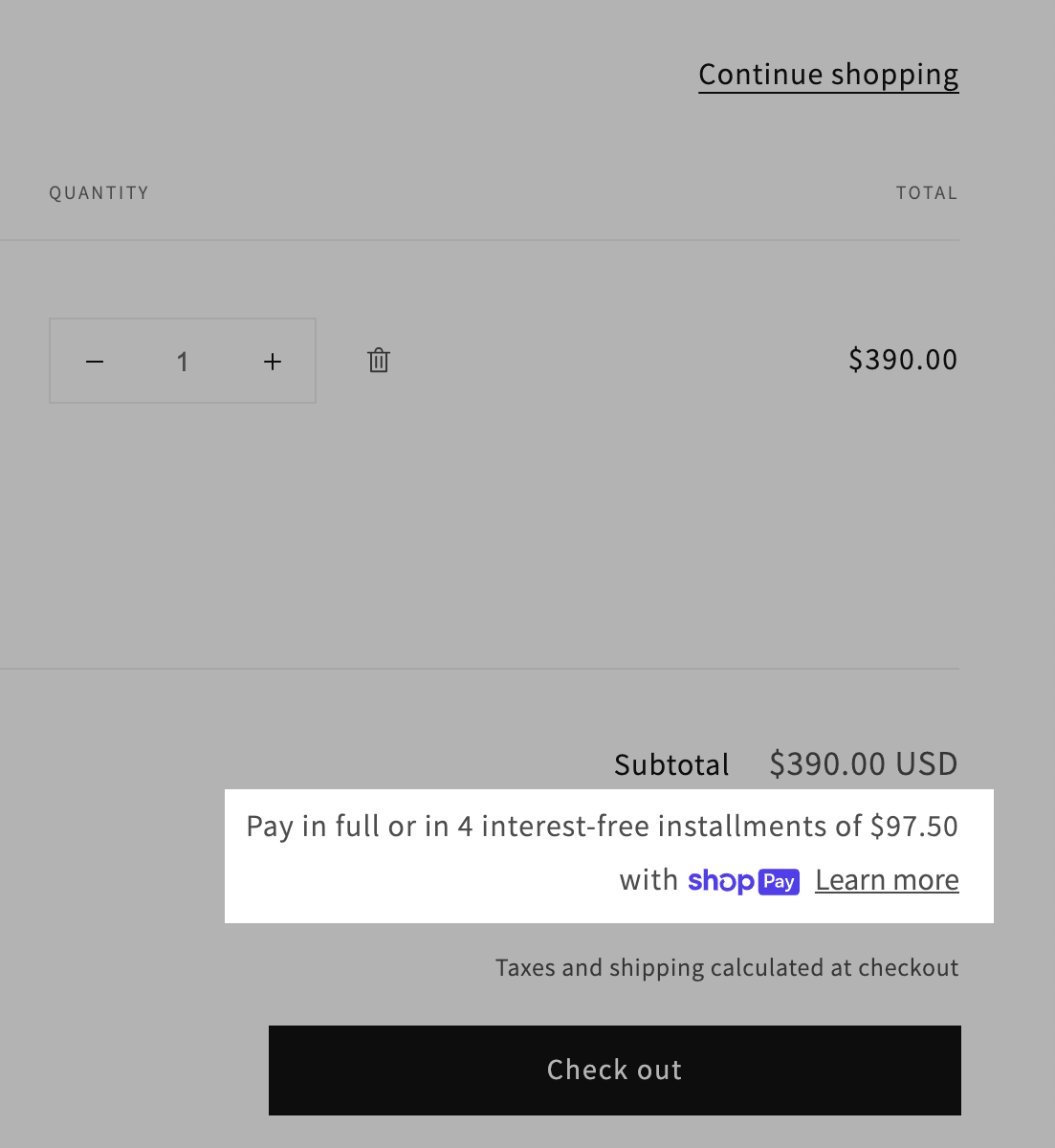

The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement. In accordance with state law property owners in California are required to pay property taxes on an annual basis. Pay a 34 set-up fee that the FTB adds to the balance due.

Vouchers to pay your estimated tax by mail. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. You pay these instalments during the year while you are earning the income similar to how an employer deducts tax directly from each pay period.

Here is a list of our partners and heres how we make money. Send us Form 593. If approved it costs you 50 to set-up an installment agreement added to your balance.

Apply online by phone or in-person. First Californias fiscal year runs from July 1st to June 30th but property taxes are regulated by each county not by each state. If youre sending your final payment write Final Installment Payment on the bottom of Form 593.

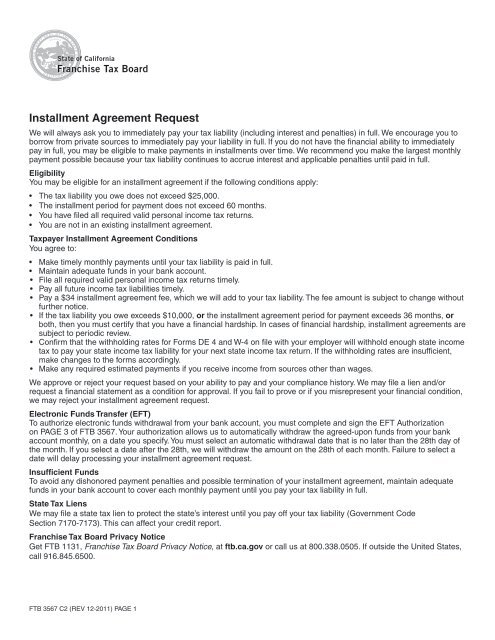

Many times an otherwise-taxable transaction will include bundled fees like excise taxes installation fees or finance charges or be modified with coupons installment payment plans etc. However its best to act sooner rather than later. In some years Californians pay more in property taxes and charges than they do in state personal income taxes the largest state General Fund revenue source.

The exclusion applies for federal and California purposes. Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. Taxpayers must pay their property tax bill in two installments.

The 100 prior-year tax is increased to 110 if the taxpayers prior-year adjusted gross income AGI exceeds 150000 or 75000 for married filing separately using California AGI. FTB is aware of multiple proposals from the Governor and Legislature to help Californians cope with rising prices of gas and other goodsWhile you may be seeing discussion in the mediasocial media on proposals related to gas prices and taxes we have no information to offer at this time because the ideas are only. What is included in Californias sales tax basis.

Property tax in California is calculated by something called Ad Velorum. That means taxes are calculated by the value of the home. The state only taxes income earned in California.

Since 1978 Proposition 13 has been.

Buy Now Pay Later Options For Ecommerce Websites Inflow

How A 390 459 Irs Debt Reached A 94 Settlement Landmark Tax Group

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Form 3567 Installment Agreement Request

Irs Letter 4458c Second Installment Agreement Skip H R Block

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

Property Tax Prorations Case Escrow

/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Sample Commercial Rental Agreement Rental Agreement Templates Room Rental Agreement Commercial

Can I Pay Taxes In Installments

Installment Agreement Request California Franchise Tax Board

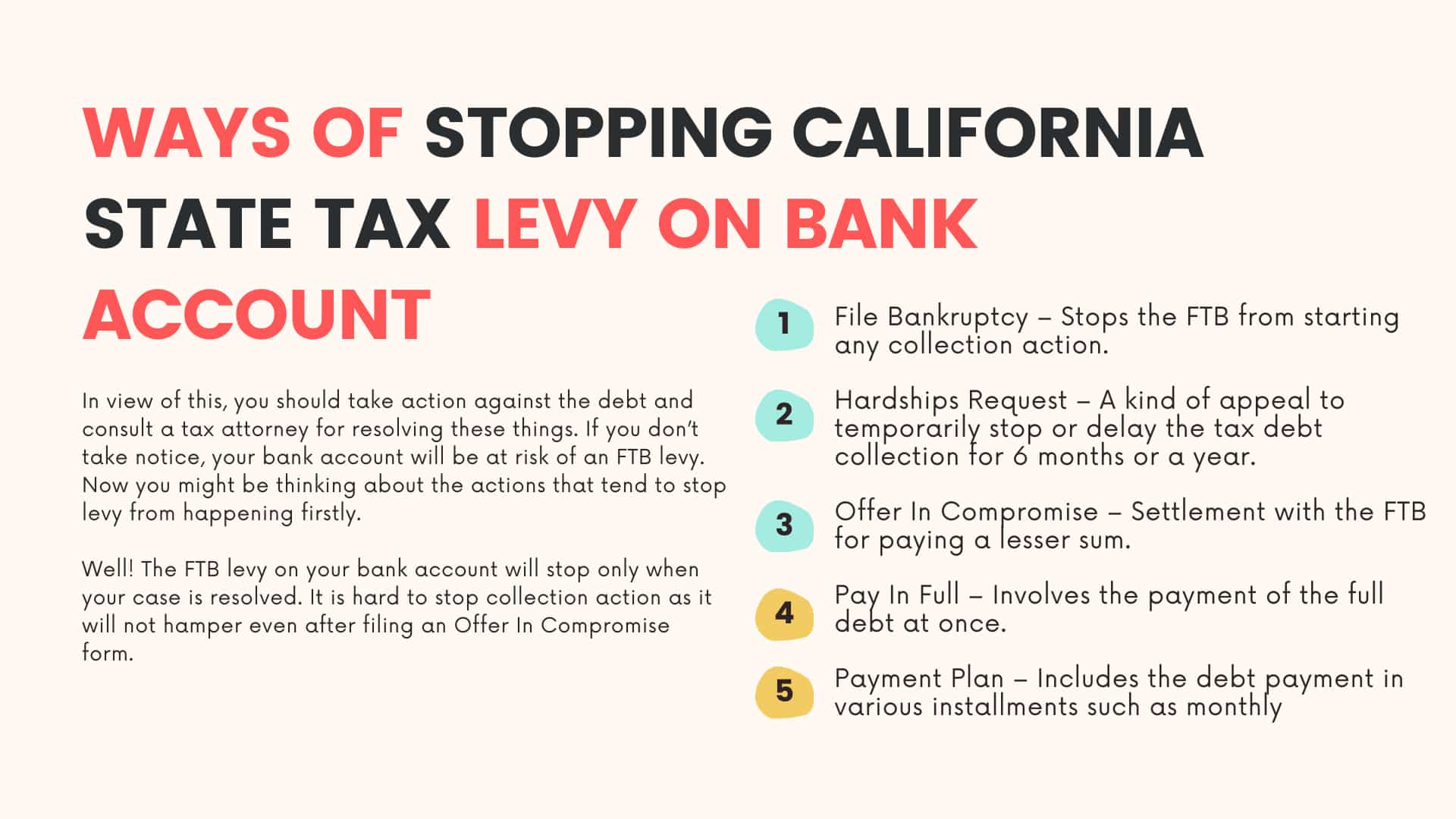

3 Proven Ways To Stop California State Tax Levy On Bank Account

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at11.00.22AM-1f51d54182cb40b0b110e0940688fbb8.png)

Form 6252 Installment Sale Income Definition

Commercial Property Lease Agreement How To Create A Commercial Property Lease Agreement Download This C Lease Agreement Lease Agreement Free Printable Lease

When Does It Make Sense To Elect Out Of The Installment Method

Lease And Buy Agreement Real Estate Forms Real Estate Real Estate Contract